- Topic

24k Popularity

24k Popularity

140k Popularity

3k Popularity

18k Popularity

- Pin

- 🎉 Hey Gate Square friends! Non-stop perks and endless excitement—our hottest posting reward events are ongoing now! The more you post, the more you win. Don’t miss your exclusive goodies! 🚀

🆘 #Gate 2025 Semi-Year Community Gala# | Square Content Creator TOP 10

Only 1 day left! Your favorite creator is one vote away from TOP 10. Interact on Square to earn Votes—boost them and enter the prize draw. Prizes: iPhone 16 Pro Max, Golden Bull sculpture, Futures Vouchers!

Details 👉 https://www.gate.com/activities/community-vote

1️⃣ #Show My Alpha Points# | Share your Alpha points & gains

Post your - 🚀 ETH jumped to $4,600 this morning, up 8.69% in 24h!

Just shy of the $4,891 ATH—think it breaks through?

📍 Follow Gate_Square, vote and drop your reason.

🎁 4 winners split $100 Futures Voucher! - 💙 Gate Square #Gate Blue Challenge# 💙

Show your limitless creativity with Gate Blue!

📅 Event Period

August 11 – 20, 2025

🎯 How to Participate

1. Post your original creation (image / video / hand-drawn art / digital work, etc.) on Gate Square, incorporating Gate’s brand blue or the Gate logo.

2. Include the hashtag #Gate Blue Challenge# in your post title or content.

3. Add a short blessing or message for Gate in your content (e.g., “Wishing Gate Exchange continued success — may the blue shine forever!”).

4. Submissions must be original and comply with community guidelines. Plagiarism or re

[Foreign Exchange] Reasons for the Yen's Stagnation After the "Employment Statistics Shock" | Yoshida Tsune's Foreign Exchange Daily | Moneyクリ MoneyX Securities Investment Information and Media Useful for Money

The narrowing of interest rate differentials following the "employment statistics shock" has paused.

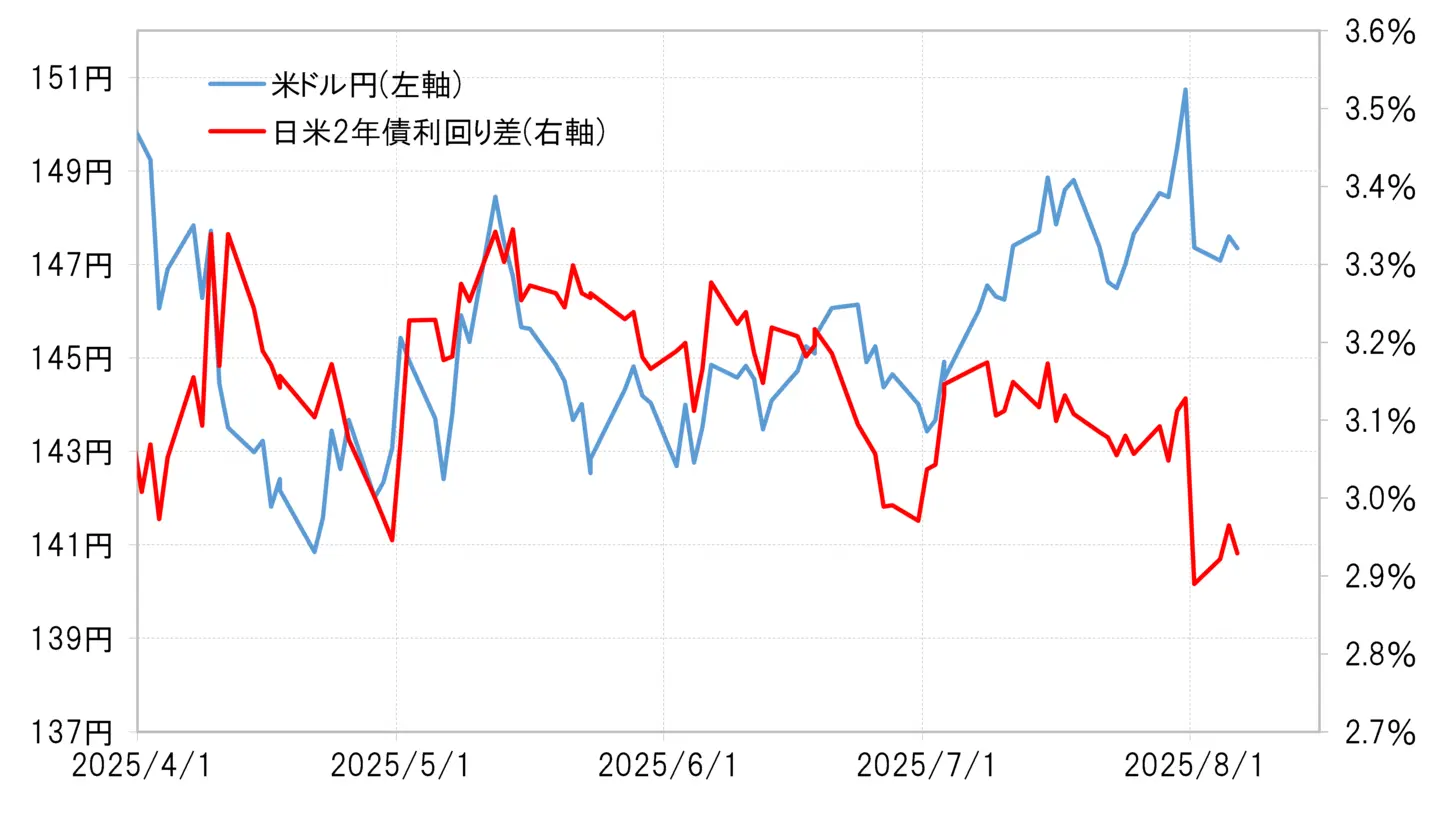

On August 1, the USD/JPY fell sharply by about 3 yen, which was referred to as the "employment statistics shock," but after the week starting August 4, it continued to decline to the 146 yen range several times, although it showed a relatively hesitant downward trend. The reason for this is likely due to a pause in the rapid contraction of the interest rate differential between Japan and the United States (USD superiority and JPY inferiority) that occurred due to the "employment statistics shock" (see Chart 1).

[Figure 1] USD/JPY and the US-Japan 2-Year Bond Yield Spread (From April 2025) Source: Created by Monex Securities based on data from Refinitiv.

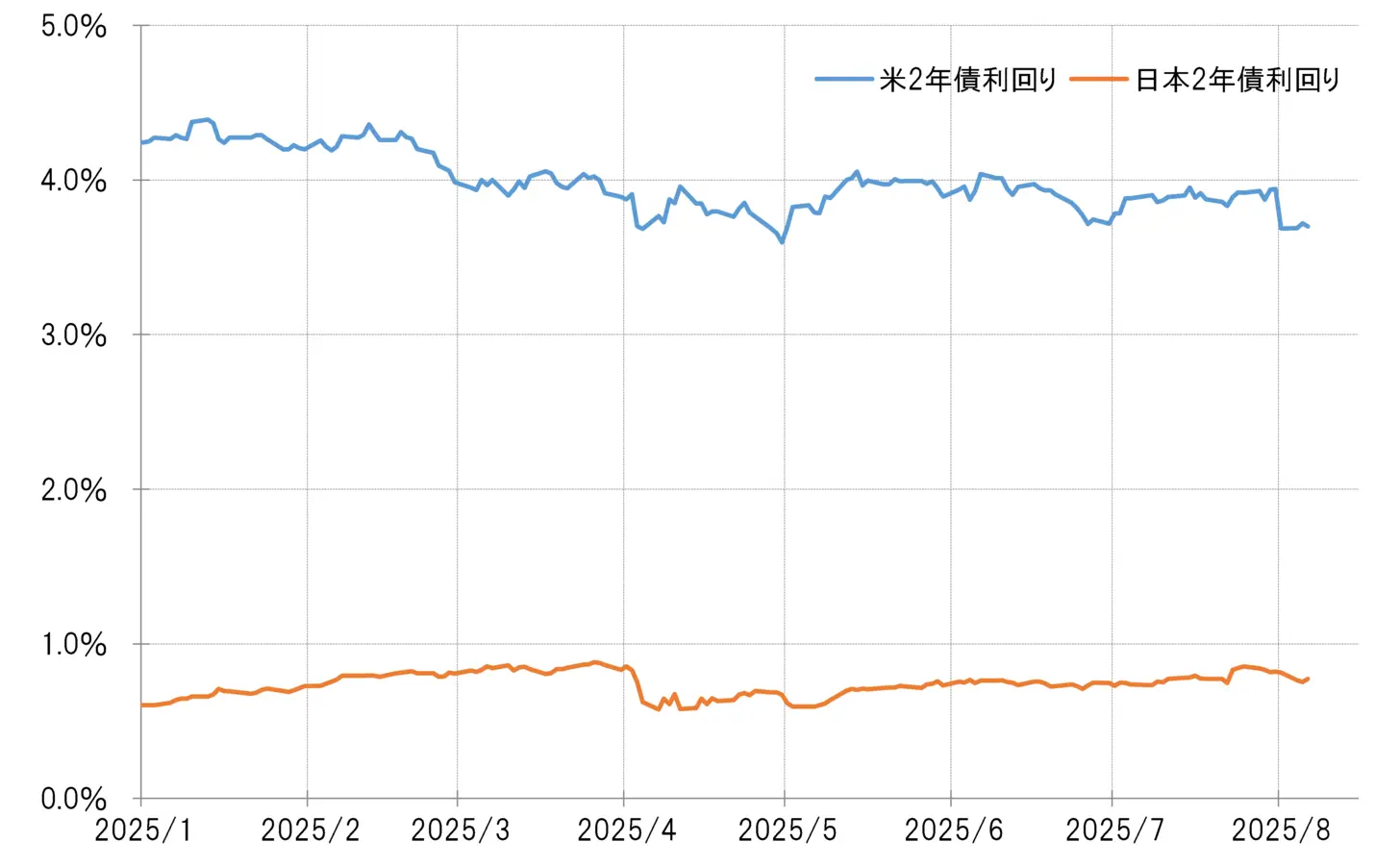

So why has the narrowing of the interest rate differential between Japan and the U.S. paused since this week (the week of August 4)? The main reason is likely due to the pause in the sharp decline of U.S. interest rates caused by the "employment statistics shock." The U.S. 2-year Treasury yield, which reflects monetary policy, dropped significantly from the 3.9% range before the employment statistics were released to near 3.7% after the announcement, a decline of over 0.2%. However, this week, there has been a noticeable reluctance to continue falling (see Chart 2).

Source: Created by Monex Securities based on data from Refinitiv.

So why has the narrowing of the interest rate differential between Japan and the U.S. paused since this week (the week of August 4)? The main reason is likely due to the pause in the sharp decline of U.S. interest rates caused by the "employment statistics shock." The U.S. 2-year Treasury yield, which reflects monetary policy, dropped significantly from the 3.9% range before the employment statistics were released to near 3.7% after the announcement, a decline of over 0.2%. However, this week, there has been a noticeable reluctance to continue falling (see Chart 2).

So why did the yield on the US 2-year Treasury bond struggle to decline this week?

[Figure 2] Japan-US 2-Year Bond Yield (From January 2025) Source: Created by Monex Securities from Refinitiv data.

Source: Created by Monex Securities from Refinitiv data.

Incorporating Early Rate Cuts Resumed in Just One Day = "Employment Statistics Shock"

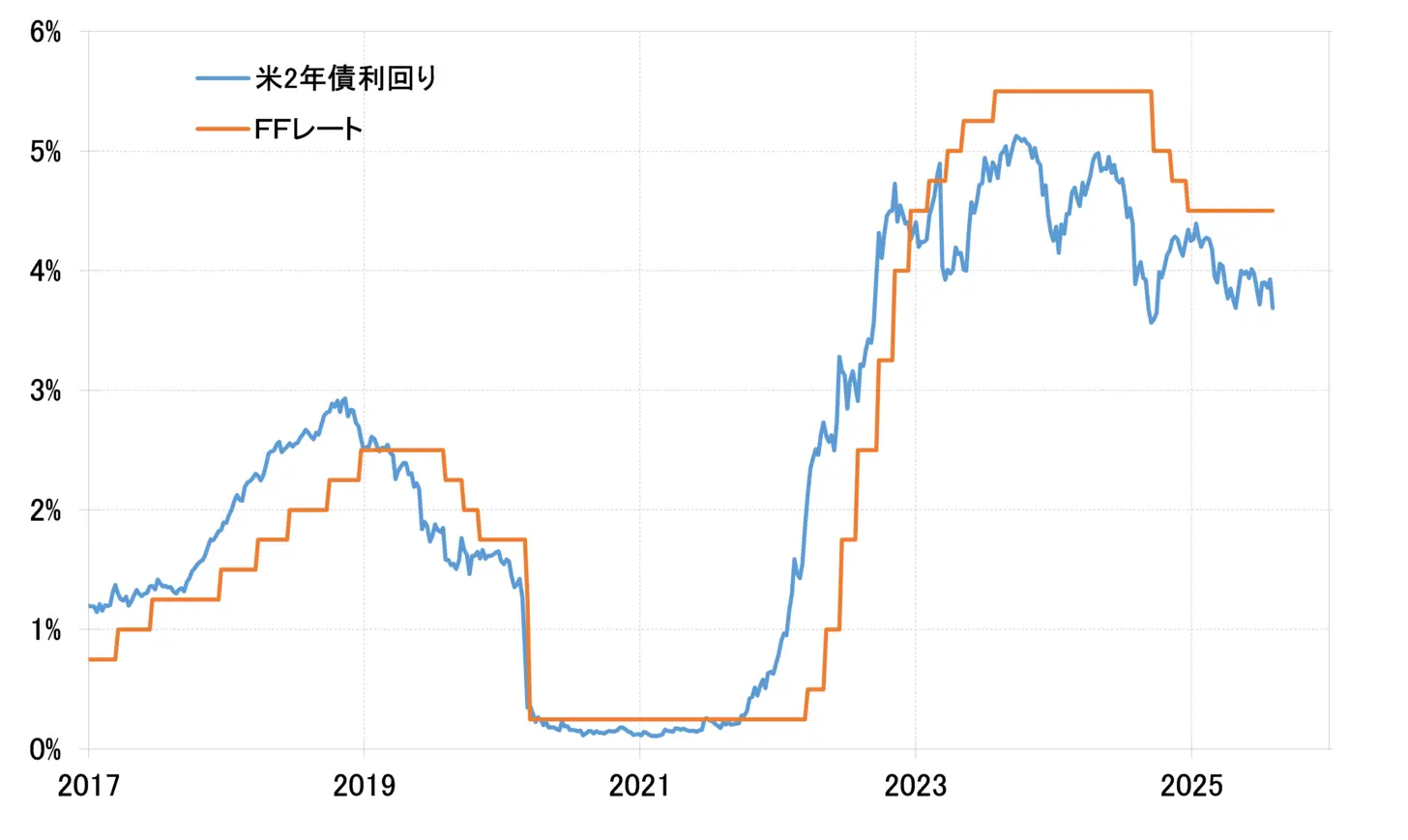

As mentioned above, the yield on the US 2-year Treasury moves in line with monetary policy. Therefore, when the view strengthens that the Federal Funds rate (FF rate), which is the policy interest rate in the US, will be lowered early, it will generally decline significantly in anticipation of the drop in the FF rate (see Chart 3).

[Figure 3] FF Rate and US 2-Year Bond Interest Rate (2017 - ) Source: Created by Monex Securities from Refinitiv data

In addition, when the Federal Reserve began its "preventive interest rate cuts" in August 2019 during the first term of the Trump administration, the yield on the 2-year U.S. Treasury bond fell more than 0.7% below the upper limit of the FF rate guidance before the rate cuts started.

Source: Created by Monex Securities from Refinitiv data

In addition, when the Federal Reserve began its "preventive interest rate cuts" in August 2019 during the first term of the Trump administration, the yield on the 2-year U.S. Treasury bond fell more than 0.7% below the upper limit of the FF rate guidance before the rate cuts started.

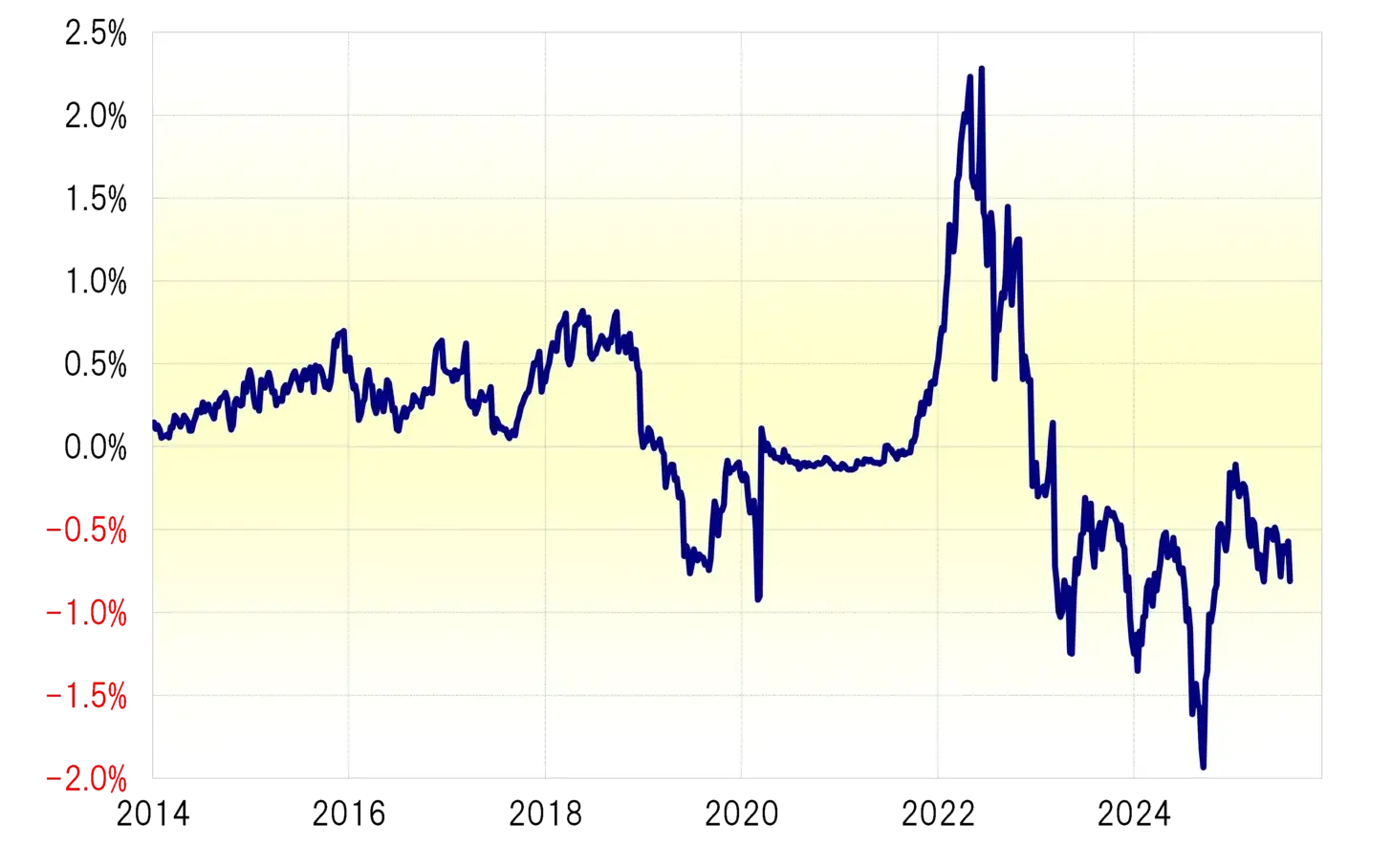

And this time, in response to the "employment statistics shock", the U.S. 2-year Treasury yield plummeted to around 3.7%. Since the current upper limit of the FF rate target is 4.5%, it has fallen by about 0.8% (see Chart 4). Considering the example of the rate cut that began in August 2019 mentioned above, it seems that the U.S. 2-year Treasury yield has fallen to a level that quickly incorporates an early resumption of rate cuts due to the "employment statistics shock". Therefore, at the beginning of the week, the decline in the U.S. 2-year Treasury yield also paused, and as a result, the narrowing of the interest rate differential between Japan and the U.S. also paused, leading to a reluctance for the U.S. dollar/Yen to decline.

[Figure 4] Spread between the FF Rate and the U.S. 2-Year Treasury Yield (2014 - ) Source: Created by Monex Securities from data provided by Refinitiv.

Source: Created by Monex Securities from data provided by Refinitiv.

Possibility of Declining US Interest Rates and Renewed Weakening of the US Dollar and Strengthening of the Yen?

If the U.S. 2-year Treasury yield has fallen to the point of pricing in a resumption of early rate cuts, it does not mean that there will be no further decline in U.S. interest rates. Before starting a significant rate cut of 0.5% in September 2024, the U.S. 2-year Treasury yield was significantly below the upper limit of the FF rate by nearly 2%.

Considering these factors, the likelihood of a resumption of interest rate cuts at the upcoming September FOMC (Federal Open Market Committee) in the U.S. has increased further, and the possibility of an "emergency rate cut" being brought forward has also emerged. Additionally, if there is a possibility of a significant rate cut of 0.5%, the yield on U.S. 2-year bonds may decline further, leading to a further narrowing of the interest rate differential between the U.S. and Japan. This could trigger a resurgence of a weaker U.S. dollar and a stronger yen.